Today we will discuss the most interesting predictions of the previous week and,

as always, we execute the most popular instruments in three groups commodities, currencies, and indices.

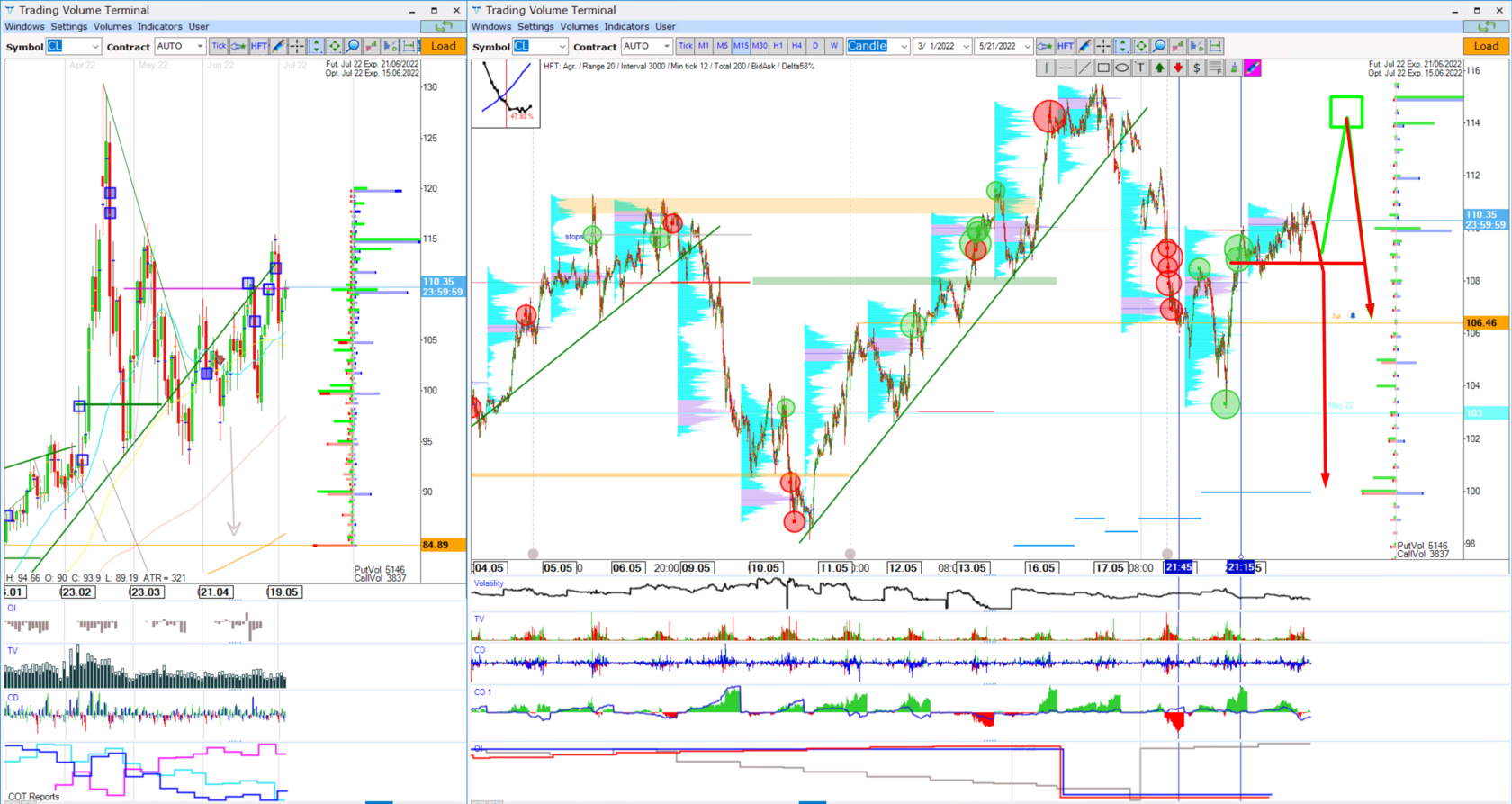

🔺 Let's start with Oil (CL). The prediction was that the price will ignore the double top formation on the 110 price level and will go higher after some correction. Really that happened, but only after a false breakout of 110 level to the upside, stops removal, involvement in shorts, and then the continuation of the uptrend. I had no entry point according to my strategy, as there was no HFT volume there, but again, the price nicely respected the 108 price and volume level to the upside. So volume levels work if we assess the global picture correctly. The next potential scenarios you can observe in this picture or in my video.

🔺 S&P500 (ES) and other indices have a chance to go higher next week one more time. We already saw a beautiful pullback after the options block trades imbalance was created on the daily wick on May, 12. And for now, we can observe an imbalance with stopping HFT volumes after the breakdown of the support structure 3850. It seems very optimistic, but the target is mapped out on the 4155 price level. Here are the option payouts level, volume level Jun 21, and old delta level.

Also you can see that funds and hedgers are hesitating about their position it is one more factor for range on the daily chart.

🔺 Don’t think about Gold (GC) that the bullish rally is over! Of course, the corrections will be, but the 1920 target is suitable for this asset. Three volume levels, big HFT volumes, amazing divergence. So moving to the downside is for sure not the path of least resistance for the price. Moreover, there is one secret for you, when I see an increase in volumes in block trades in some asset, it means that afterward there will be some significant movement, so the task is only to find an entry point.

🔺 Silver (SI) reached my target of 22, but after a small correction and the creation of HFT volumes, by the end of Friday, the next target is 22.50. At that zone, option payouts level and fresh volume level of Mar 22 are waiting for the price.

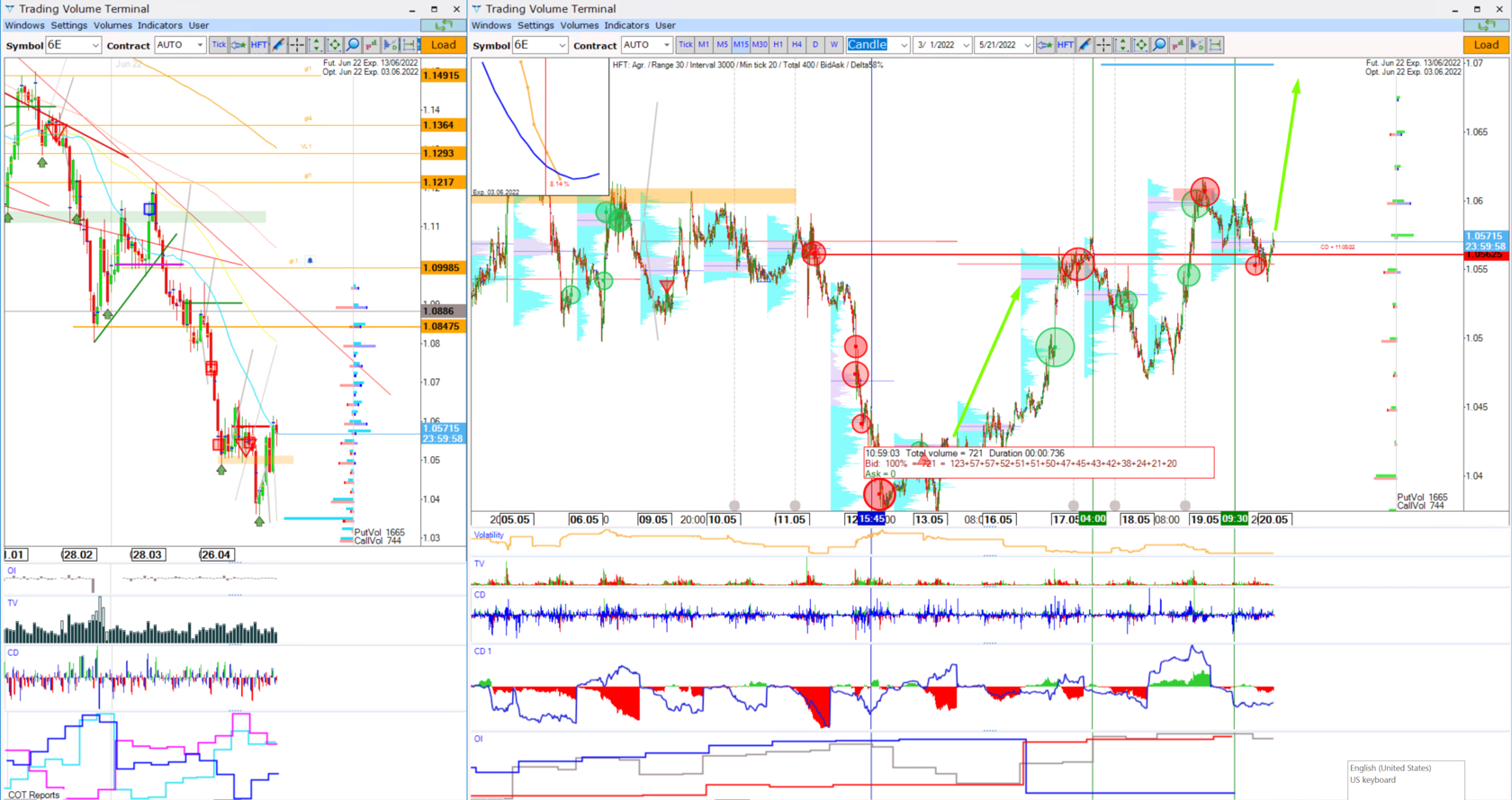

🔺 Euro (6E) recently achieved commercial level 1.06. After the last BID HFT volumes on Friday, we can expect further continuation to option payouts level 1.07.

For the British pound (6B) target is 1.2725. Previous big options trades also work as magnet levels for the price.

Funds have even not started to close their shorts…

See more information in video

As a result, my trading priorities are:

Gold (GC) - buy

Silver (SI) - buy

Euro (6E) - buy

S&P 500 (ES) - buy

Oil (CL) - range

Have a good week!

(Previously published in TVT School)

Sincerely, Taras Sviatun

Team Trading Volume Terminal