Good afternoon, traders!

Today I have no possibility to make a video forecast, but I want to measure some ideas for you.

Today I have no possibility to make a video forecast, but I want to measure some ideas for you.

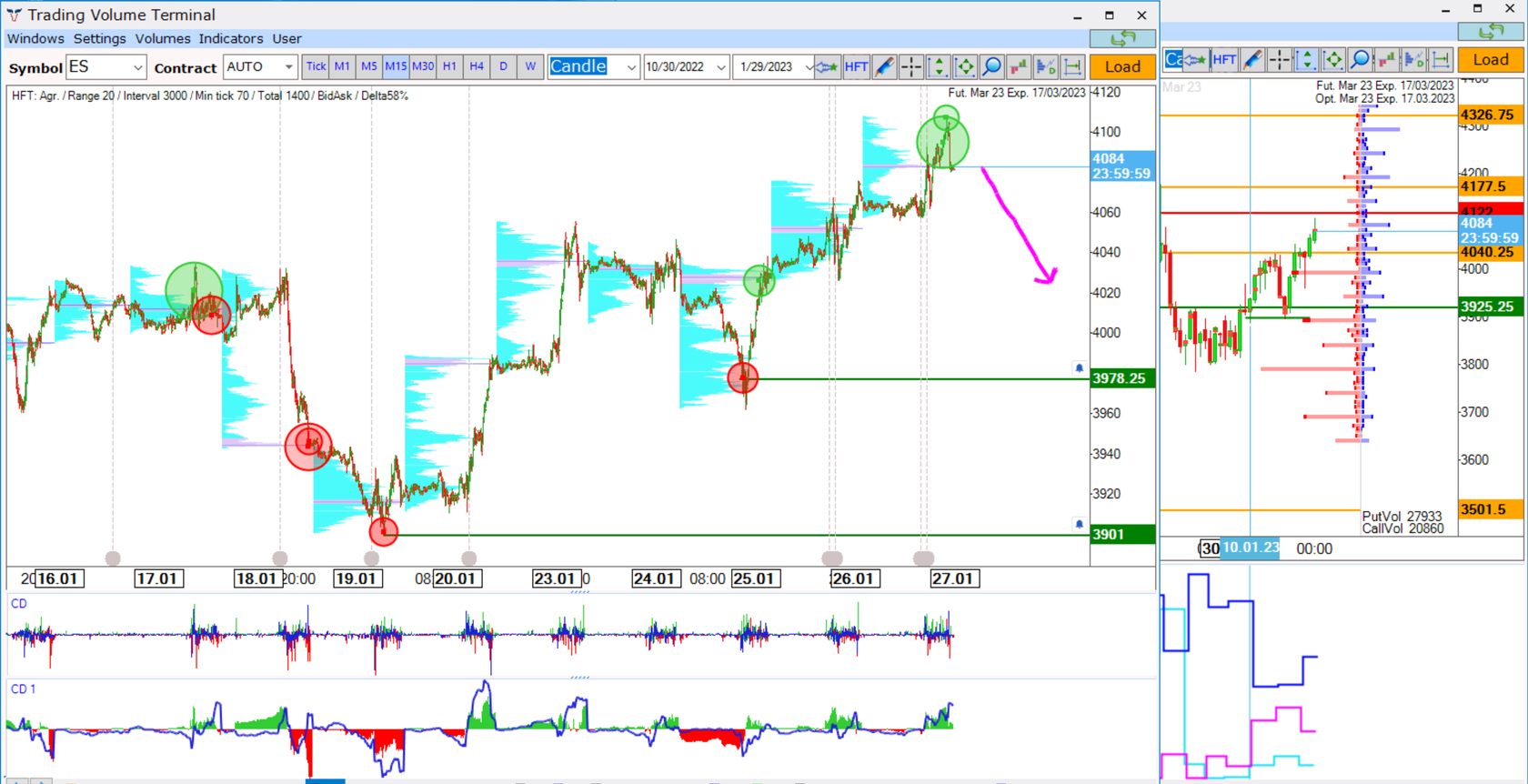

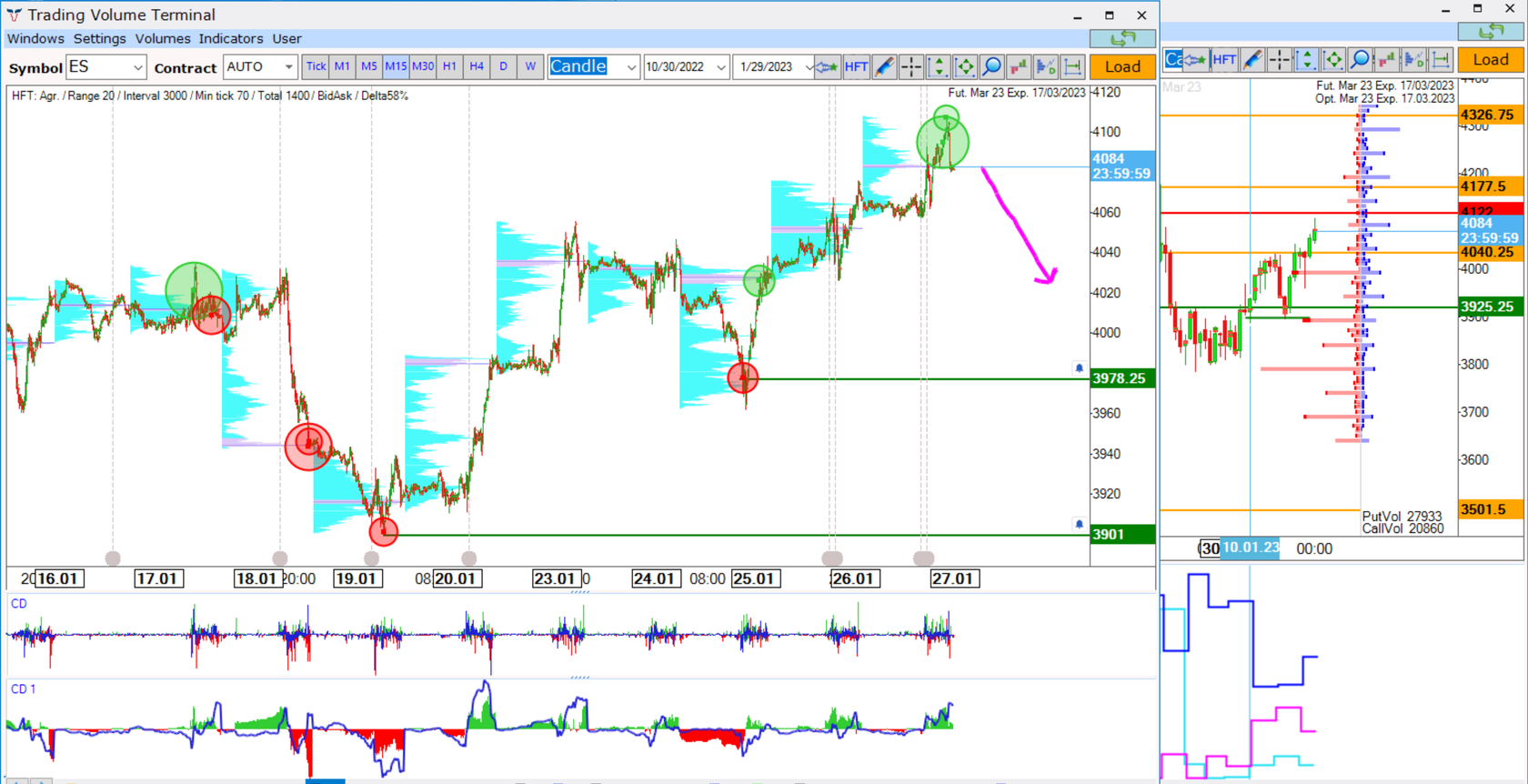

S&P 500 (ES)

The price closed below the huge Ask tick chain near 4100, not achieved to the supply zone, and made a fast pullback. I see shorting opportunity, that the price will reach the 4020 price level.

On Silver vice-versa we see a Bid tick imbalance and some accurate algorithmic purchases on Friday according to the cumulative delta quantitative (CDQ) which diverges with the volume delta (CD). The price is coiling in the long-range during last 2 months and has a high probability to move toward the upper boundary and break it.

Copper made a peculiar squeeze of buyers, created a Bid tick imbalance, and bounced back from a commercial level into the range. Hedge funds continue aggressively buying the asset, increasing their longs by 18% with the OI increase by 6%.

We see a very strong divergence between CDQ and CD, clear absorption of stoploss liquidity with algorithms.

So I am very bullish here.

Silver (SI)

On Silver vice-versa we see a Bid tick imbalance and some accurate algorithmic purchases on Friday according to the cumulative delta quantitative (CDQ) which diverges with the volume delta (CD). The price is coiling in the long-range during last 2 months and has a high probability to move toward the upper boundary and break it.

Copper (HG)

Copper made a peculiar squeeze of buyers, created a Bid tick imbalance, and bounced back from a commercial level into the range. Hedge funds continue aggressively buying the asset, increasing their longs by 18% with the OI increase by 6%.

We see a very strong divergence between CDQ and CD, clear absorption of stoploss liquidity with algorithms.

So I am very bullish here.

I wish you a profitable upcoming week!

(Previously published in TVT School)

Sincerely, Taras Sviatun