🔻 In the previous analysis, we made a bet to follow shorts in Gold (GC), but for now, I see local buying opportunities according to the last HFTs’ bid imbalances. Ask delta on bid HFTs’ and close below this descending triangle is comfortable for bears but can be used by market makers to accumulate a bigger long position. For me the key level is volume level Feb21, if the price will break this level, it will be a bukkish signal for buyers.

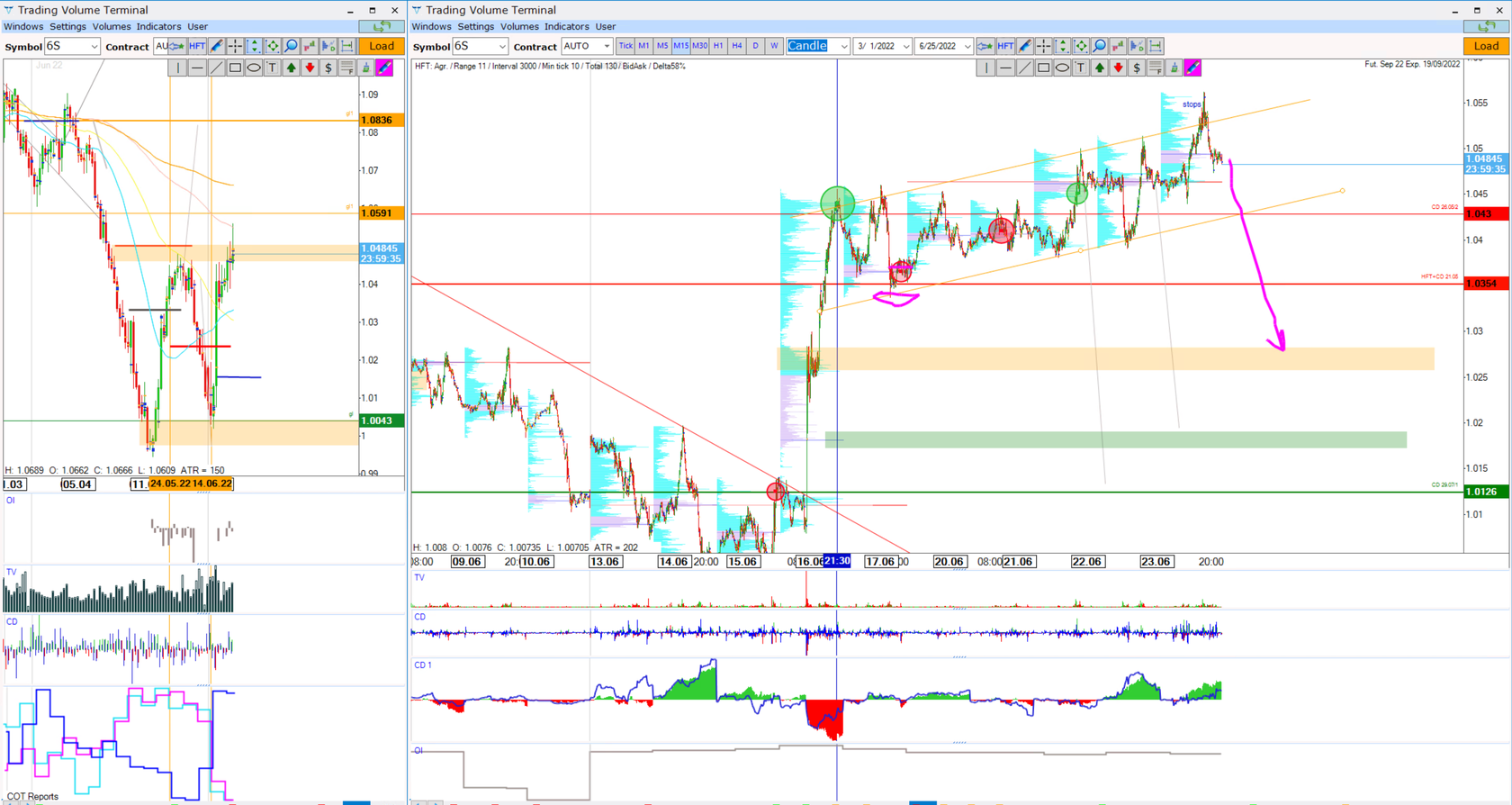

🔻 While if we look at Swiss frank (6S) it can still bounce back. As you remember I said if the price break this HFTs’ level, it will go down. It did not, but now the magnet zone is on the 1.025 price level.

🔻 For New Zealand dollar (6N) the picture is also shortable after delta divergence and HFTs’. This HFTs’ does not mean stops, as you see they are inside the range, but probably someone who expected falling of this asset exited on market maker limits.

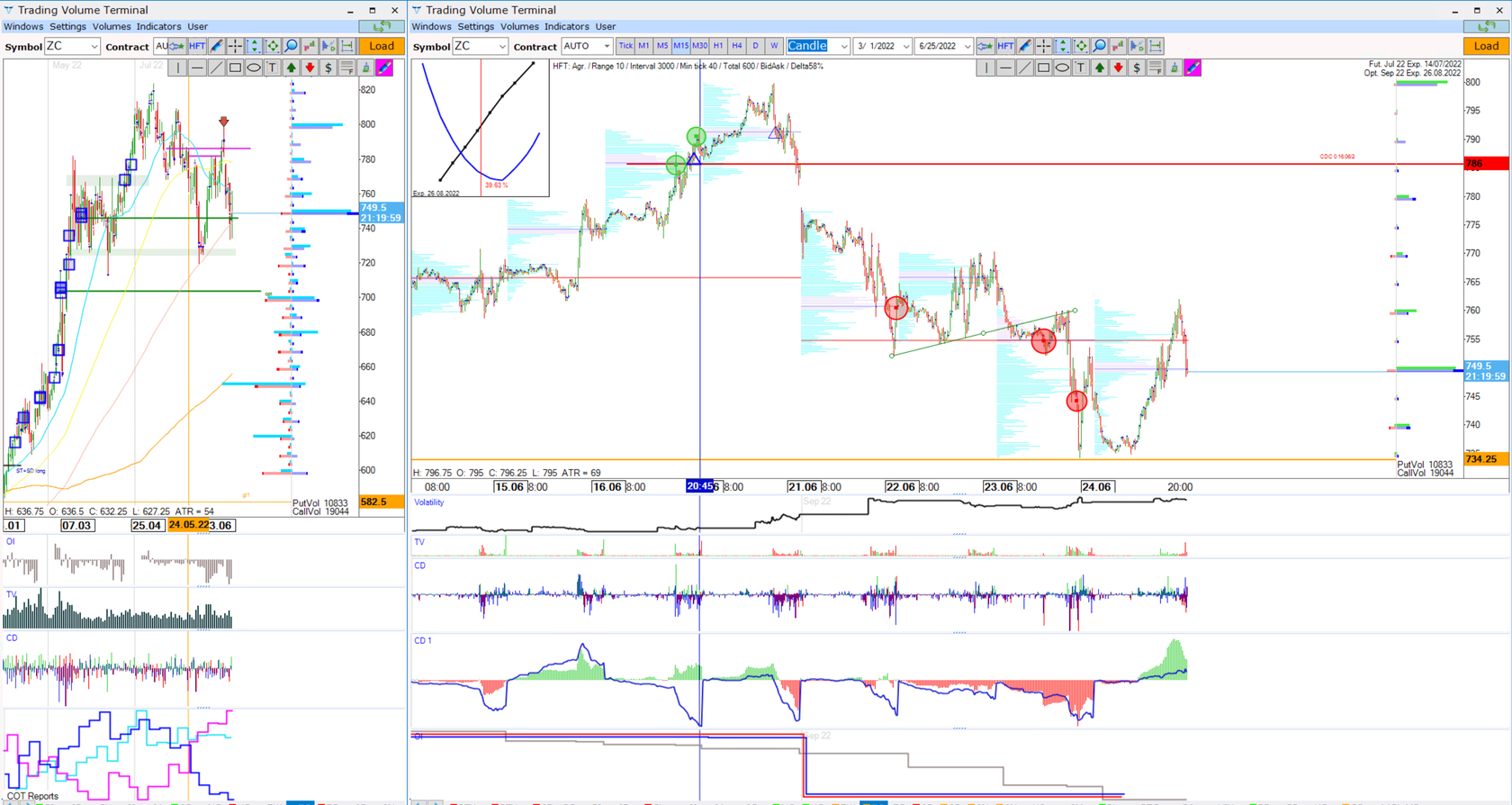

🔻 What about Corn (ZC) and Wheat (ZC), they really felt enough and we see local imbalances, which likely hold the price here in some range. There are 2 important zones of Supply in Corn: the current 750$ and the next 705$. We can stay for some time in the current zone or even make some bounce from it. But after breakout, the price will fall lower to the next supply area. By the way, wheat can also bouns from the old commercial level and at the same time zone of supply on the 715$ price level.

🔻 Zone 2425 is very importante for Cocoa (CC) . It is significant price zone whear OI rose and big short of hedgefunds was accumulated. We can really try to buy from this zone, or sell after its breakout. The details see in video review.

Wish you a profitable upcoming week!

📹 See more information in video ⬇️

(Previously published in TVT School)

Sincerely, Taras Sviatun

Team Trading Volume Terminal