Let's overview and discuss potential scenarios for the futures market.

The previous week was very powerful for predictions, especially on gold, silver, and Mexican peso. Let's see and try to find what to do next.

🔺 Gold (GC) dropped sharply after big volume trades in call options. Now we already have statistics, that gold always respects the important volume bloke trades, which are equal to or bigger than 300 contracts traded in 1 minute, and which are in the money. That often means closing or opening a big hedge. Definitely, it happens on extremums or market lows, where emotions are very high. Now gold has some chances to reverse locally, indeed it is oversold right now. We see a divergence between volume cumulative delta and quantitative. And I am waiting for some HFTs’ after downside movement to make a short-term bullish swing. But the market looks rather bearish right now.

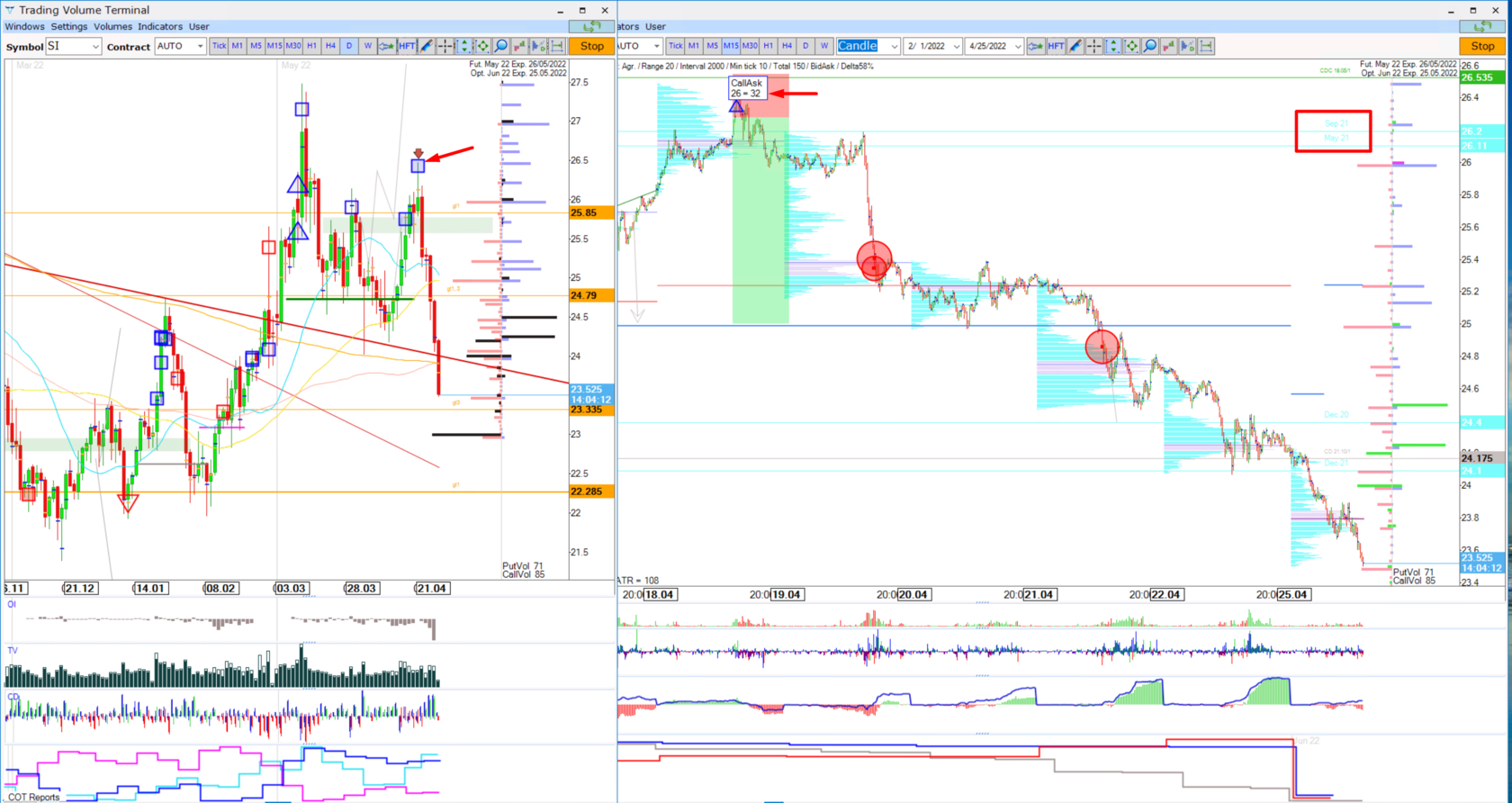

🔺 We see an even greater picture in Silver (SI). Here also block trades in call options showed to us a fantastic signal for short. Here we have more noise in these options trades, and of course, it is necessary to find confirmations. Here we saw also trades in the order book by ask and the strong resistance from two volume levels.

🔺 Mexican peso (6M) waited too long, very deep reversal but nevertheless, the target was achieved.

🔺 The Canadian dollar (6C) after the reversal pattern also went down from the commercial level because of the dollar strength. Such a dramatic buy position increased by funds, but in range, as I told you before it is more often a sell signal.

🔺 I hoped that Sugar (SB) will go up, but unfortunately it went down. If it was pure involvement in shorts, it would work. But the stops of the sellers from the trendline were taken out, and I had to take into consideration this aspect.

🔺 For now, I see trend continuation in Ultra US Treasury Bonds (UB), moreover, it will be a short squeeze the position that funds accumulated before. And we see on quantitive delta the activity of algorithms.

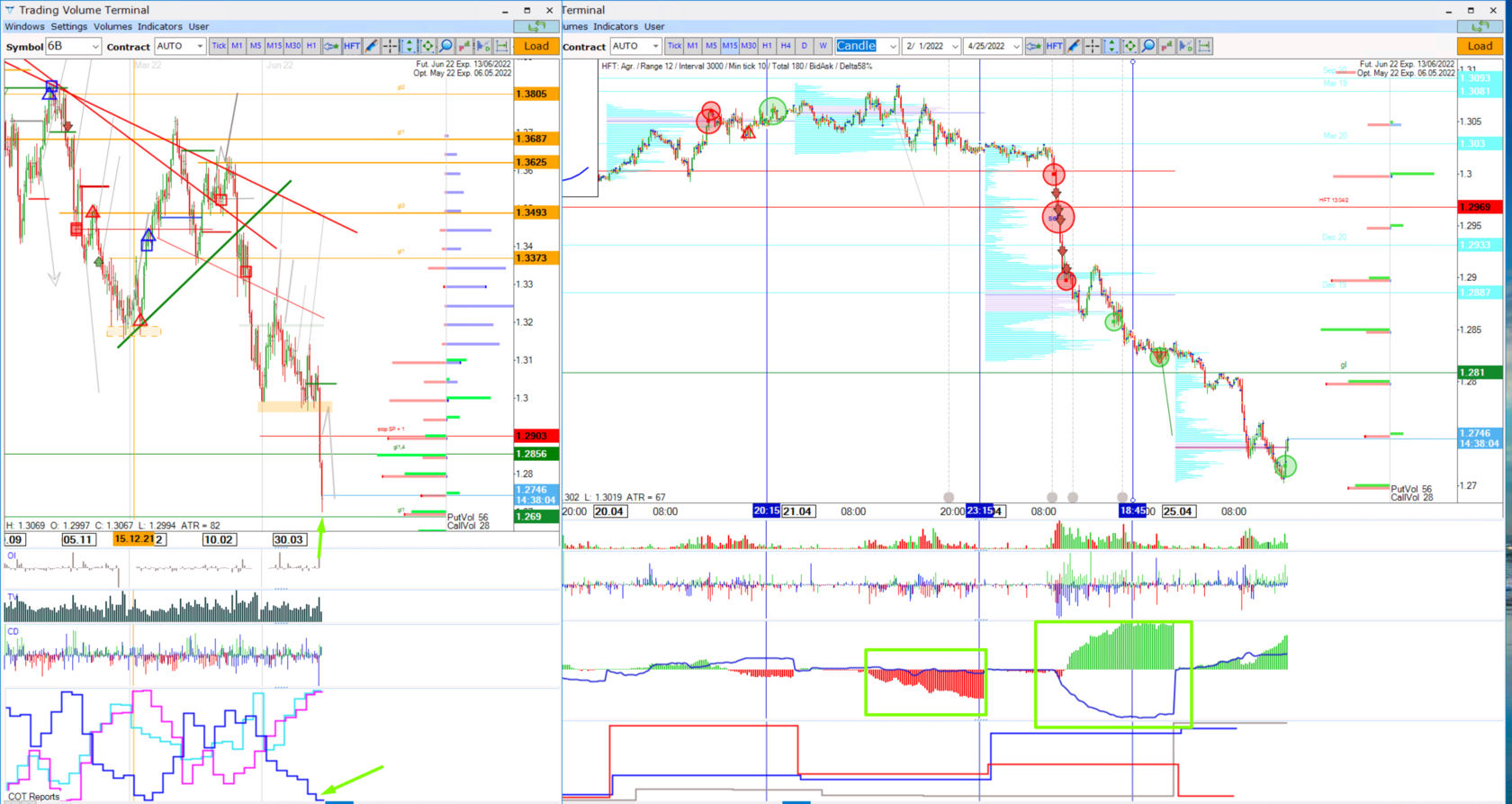

🔺 Also, I am waiting for a pullback in the British pound (6B), we have extremal shorts accumulated by hedgefunds and there was such a strong divergence in volume and quantitative delta with the OI increase. So huge advance purchase by hedgers, I need to put buy priority on it.

🔺 And Crude Oil (CL) is nothing but a sell with very big potential after a huge call block.

🔺 Japanese Yen (6J) has a big potential for buyers after a hard-rock collapse. And I am again waiting for more clear signal to make a long trade, I already saw a buying opportunity with red HFTs’ but the green one afterwards made me doubt.

As a result:

US treasuries (UB) - buy

Japanese Yen (6J) - buy

British pound (6B) - buy

Crude Oil (CL) - sell

Do not accept this information as financial, investment, trading, or other advice or recommendation. Manage your risk and be very attentive to your decisions and make them by yourself!

(Previously published in TVT School)

Sincerely, Taras Sviatun

Team Trading Volume Terminal