Increase your trading income with liquidity flow analysis!

14 years

trading experience on

CME, NYSE, FOREX.

14 DAYS

if it doesn't fit you

refund within

more then

PROFIT

if you follow the rules and keep a traders diary

take

PLATFORM

for a complex analysis of markets,

which we use ourselves

course from the authors of TVT

TRADE LIKE A PRO course

from

Trader from

TOP-5 Traders World Cup

Submit your request

We will contact you shortly

By submitting your data, you confirm that you have read and agree to our privacy policy, public offer agreement and disclaimer policy

get a best foundation

for a successful start in trading

get a proven working strategy

that will help to develop their skills

that will help to develop their skills

expand their horizons in understanding the market

For beginners

For intermediet traders

For experienced traders

Who does it suit?

Results after course

-

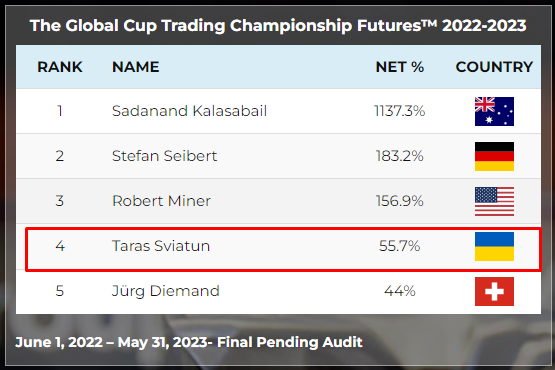

Top adviserTaras Sviatun in the TOP-5 traders at the The Global Cup Trading Championship Futures™️ 2022-2023

Top adviserTaras Sviatun in the TOP-5 traders at the The Global Cup Trading Championship Futures™️ 2022-2023 -

Strategybased on order flow analysis and volume analysis

Strategybased on order flow analysis and volume analysis -

3-12 monthusing professional software for market analysis ( saving 150$-600$) TVT platform

3-12 monthusing professional software for market analysis ( saving 150$-600$) TVT platform -

500$ - 5000$savings on brokerage fees, trade only valuable situations

500$ - 5000$savings on brokerage fees, trade only valuable situations -

1 000 hourssave your time on investigations, absorb verified experience

1 000 hourssave your time on investigations, absorb verified experience

-

9 Lessonswhich reveals valuable things that influence the market and the quintessence of the trading approach

9 Lessonswhich reveals valuable things that influence the market and the quintessence of the trading approach

Organize your workspace

Lesson #1

All we need to know about Delta!

Lesson #2

HFT volumes

Lesson #3

Visualization of "Time&Sales" is the next most important thing after the delta. With the help of the "HFT Volumes" indicator, we try to find the most valuable tick chains.

Delta is the most important indicator for analyzing the supply and demand of any asset. To be aware of the market efforts and their results.

To start your trading with the help of volume analysis tools start with your personal workspace. Only objective facts, nothing unimportante and insignificant.

Course content

How to make HFT volumes settings?

Lesson #4

Identify when big ticks are valuable for MarketMaker!

Lesson #5

The most popular technical patterns we are trading against

Lesson #6

There are no traders in the world who ignore to draw on graph. Trendlines, levels of

support and resistance, doble tops and double bottoms, head and shaulders, engulfing candles.

support and resistance, doble tops and double bottoms, head and shaulders, engulfing candles.

The primary source of all charts is a tick chart. The seed of the tick chart is a valuable tick chain. We need to know whether stop-losses were executed, or new money entered the market.

How to find important pivot points on the assets? This video will help you to make HFTs' filter settings totally by yourself without wasting a lot of time.

Volumetric supply and demand zones + commercial levels

Lesson #7

Of course, volumes are as popular now as technical patterns 30 years ago. So we need to see support and resistances based on volumetric analysis. As these places are also juicy for MM manipulations.

The course consists of 9 lessons, tests, tasks, and finally simulation. Support and video analysis of all your decisions which cause a decisive breakthrough in your trading. Additional online Q&A sessions of 30 minutes.

Успей записаться на курс

Strategy

Lesson #8

This is the quintessence of my 15 years of experience. At first it grew, and now narrowed down to 7 basic rules.

Simulation

Lesson #9

Before you sit down on a fighter jet, you need to try yourself on a simulator. See the video how to pass this the most importante task and read the rules according to this simulation.

Taras Sviatun

In the TOP 5 traders of Robbins World Cup Trading Championship 2022-2023. Expert in the development and usage of Trading Strategies based on the analysis of market volumes and liquidity flows.

The course is for traders, who already understand what is the order book, bid and ask, open interest, limit, and market orders. Has already made trades on a real or demo account.

If the question "What moves the markets?", you answer "Volumes or liquidity" then my course will be interesting and understandable for you.

If the question "What moves the markets?", you answer "Volumes or liquidity" then my course will be interesting and understandable for you.

Skills after course

- Learn to understand the essence of the market and to look inside

- Offload fear and uncertainty before entering a trade

- Find entry points by yourself with a big advantage

- Learn to see the background of the upcoming movement

- Learn to see the market maker and his intentions, identify the places of crowd panic

- Set a stop loss in defensive place, and also exit the position so as not to miss most of the movement

Your development path

Lesson #1

Organize your workspace

Organize your workspace

- Get in touch with TVT

- Prepare all charts for 25 assets

- Indicators that are the most valuable

- Why do we need them for making decisions?

Lesson #2

All we need to know about Delta!

All we need to know about Delta!

+ Quantitative volume delta (CD)

+ Cumulative quantitative delta (CDQ)

+ Cumulative quantitative delta (CDQ)

- Delta interpretation

- Advance purchases

- Culmination of sales

- Divergence of Deltas

- Algorithmic purchases

- Delta + HFT volumes

- Сounterattacks

- How to estimate the probability of trend continuation using CDQ?

- The most effective Delta tactics

- Cases - examples

Lesson #3

HFT volumes

HFT volumes

- Where do HFTs' come from?

- Time & Sales details

- Tick chart

- Stop-losses and involvement

- Tick chain details

- Practical usage

Lesson #4

How to make HFT volumes settings?

How to make HFT volumes settings?

- Quick preparation of 25 assets

- Maximum range (pips)

- Maximum interval (mls)

- Minimum tick volume

- Minimum total volume

- Delta filter

Lesson #5

Identify when big ticks are valuable for MarketMaker!

Identify when big ticks are valuable for MarketMaker!

- Analyzing the character of the tick chain

- Adding open interest

- Liquidation of positions

- Why is it so beneficial?

- Examples

Lesson #6

The most popular technical patterns we are trading against

The most popular technical patterns we are trading against

- How the market maker beats the crowd?

- Levels/zones of support/resistance

- Trendlines

- Candlesticks (Pinbars, Engulfing candles)

- Graph patterns (H&SH, Double top/bottom, Wedge pattern/Triangle

Lesson #7

Volumetric supply and demand zones + commercial levels

Volumetric supply and demand zones + commercial levels

- How to set correctly S&D levels?

- HFT volumes levels

- Market Profile (POC) level

- How to measure COT data?

- Commercial levels

Lesson #8

Strategy

Strategy

- All the strategy rules and their meanings.

- Meaning of Intuition

- Good ratio

- Load chains

- How to set stop losses correctly?

- Where to expect a clear target?

- Many strategy example

Lesson #9

Simulation

Simulation

- Setting up a real trading simulator

- Work out a strategy with market replay

- Developing decision-making skills without losing capital

- Learning all the nuances of interaction with the rules of the strategy

- Keeping the trading journal

- Checking your trades

Training package

Content

Must Have

Trading +

Personal coaching

Lesson #1

"Organize your workspace"

"Organize your workspace"

Lesson #2

"All we need to know about Delta!"

"All we need to know about Delta!"

Lesson #3

"HFT volumes"

"HFT volumes"

Lesson #4

"How to make HFT volumes settings?"

"How to make HFT volumes settings?"

Lesson #5

"Identify when big ticks are valuable for MarketMaker!"

"Identify when big ticks are valuable for MarketMaker!"

Lesson #6

"The most popular technical patterns we are trading against"

"The most popular technical patterns we are trading against"

Lesson #7

"Volumetric supply and demand zones + commercial levels"

"Volumetric supply and demand zones + commercial levels"

Lesson #8

"Strategy"

"Strategy"

Lesson #9

"Simulation"

"Simulation"

Personal Coaching sessions using an individual approach

Coach trades in real time.

Open > stop-loss > exit.

Open > stop-loss > exit.

Support during training

Answer all questions in messanger 2 times a week

Answer all questions in messanger also by voice. Personal video analysis of your trades.

Maximum Feedback.

Coach sessions and video analysis of your trades when you need it.

Coach sessions and video analysis of your trades when you need it.

Free use of professional trading softwareм TVT (gift)

2 month

(saving $98)

(saving $98)

3 month

(saving $147)

(saving $147)

6 month

(saving $294)

(saving $294)

Do you have any questions?

Taras Sviatun

In TOP-5 Traders from The Global Cup Trading Championship Futures™️ 2022-2023

World Championships of Traders Robbins Cup

World Championships of Traders Robbins Cup

Note (important!)

* - when maintaining a log of trades according to the strategy,

- compliance with risk management

- the availability of the necessary funds on the account being traded, based on this risk management

* - when maintaining a log of trades according to the strategy,

- compliance with risk management

- the availability of the necessary funds on the account being traded, based on this risk management