Good evening, traders! 👋

Let's start our Sunday review.

▪️ According to COT fresh Data, I have never seen Small Traders have a such willingness to buy Nasdaq(NQ). They closed all their 30K short and opened 3K longs during 3 weeks. 😱

Let's start our Sunday review.

▪️ According to COT fresh Data, I have never seen Small Traders have a such willingness to buy Nasdaq(NQ). They closed all their 30K short and opened 3K longs during 3 weeks. 😱

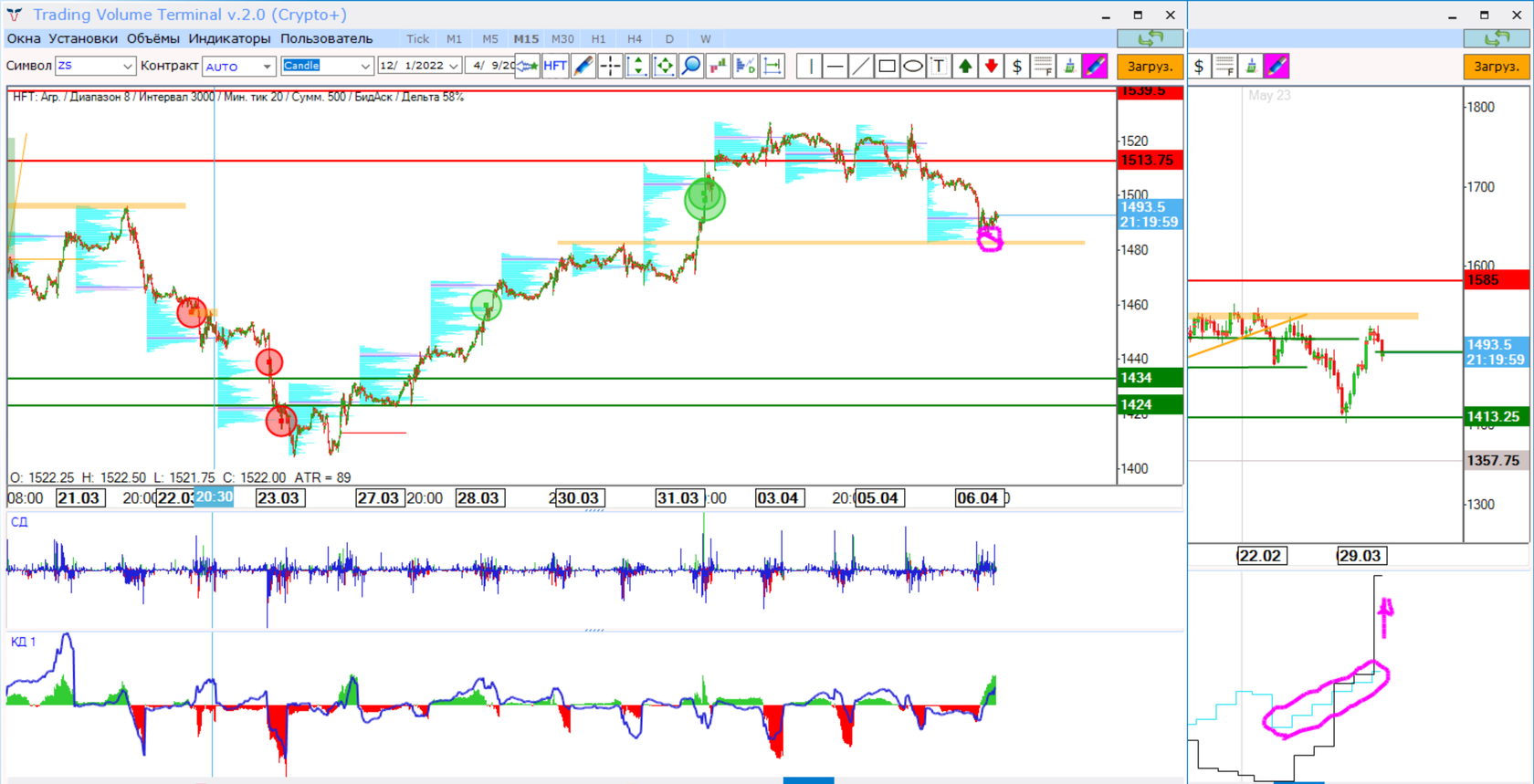

▪️ Next asset where small traders are so active - Soybeans (ZS). OI rises every week and they added longs by 20%. We can see involvement from the current mirror level and then move in the breakdown direction.

▪️ Hedge funds added 10% - 20K longs in Gold (GC), and continue accumulating, but I assume that after some involvement of buyers, we should see a correction.

▪️ Interesting situation in Natural Gas (NG). Instead of distribution, we see the additional accumulation of OI +7%. 🤪

Big trades in options and futures at the bottom of the market. The pullback is very probable.☝️

Big trades in options and futures at the bottom of the market. The pullback is very probable.☝️

▪️ Dollar Index (DX) closed below the point where it opened the week opposite my expectations.

On Friday, the price closed above the important HFTs’ support and has the potential to go to the upside.

On Friday, the price closed above the important HFTs’ support and has the potential to go to the upside.

Thank you for your attention and have a good day and the next week!

(Previously published in TVT School)

Sincerely, Taras Sviatun