Good evening, dear traders!

Today I want to show you some interesting situations in the commodities market.

▪️ The previous week I spoke about Natural gas (NG) and we really saw a pullback after the HFT volumes. Such a picture was repeated on Friday after 2 days divergence of deltas, and for now, the potential of the uprising movement is even stronger.

We had stop-loss hunting and involvement cocktail which is the fuel for MM, hedge funds shorted 2 weeks in a row. Earlier everybody tried to buy this cheap asset, but the price couldn't go to the upside till this Bid imbalances.

Today I want to show you some interesting situations in the commodities market.

▪️ The previous week I spoke about Natural gas (NG) and we really saw a pullback after the HFT volumes. Such a picture was repeated on Friday after 2 days divergence of deltas, and for now, the potential of the uprising movement is even stronger.

We had stop-loss hunting and involvement cocktail which is the fuel for MM, hedge funds shorted 2 weeks in a row. Earlier everybody tried to buy this cheap asset, but the price couldn't go to the upside till this Bid imbalances.

▪️ In Crude oil (CL) the market made several Ask imbalances, and for now, is ready to make a correction to the 80.5 price level.

▪️ But at the same time, I see a Bid imbalance after the divergence of Deltas on Brent Oil (BR) and the potential to move forward 87.5-88.

Who will win? That is a question.

▪️ Soybeans (ZS) bounced from the technical mirror level and also the commercial level, but according to strong enforcement of quantitative delta into these levels, I assume it will fall to the 1460$ the next week.

▪️ Soybeans (ZS) bounced from the technical mirror level and also the commercial level, but according to strong enforcement of quantitative delta into these levels, I assume it will fall to the 1460$ the next week.

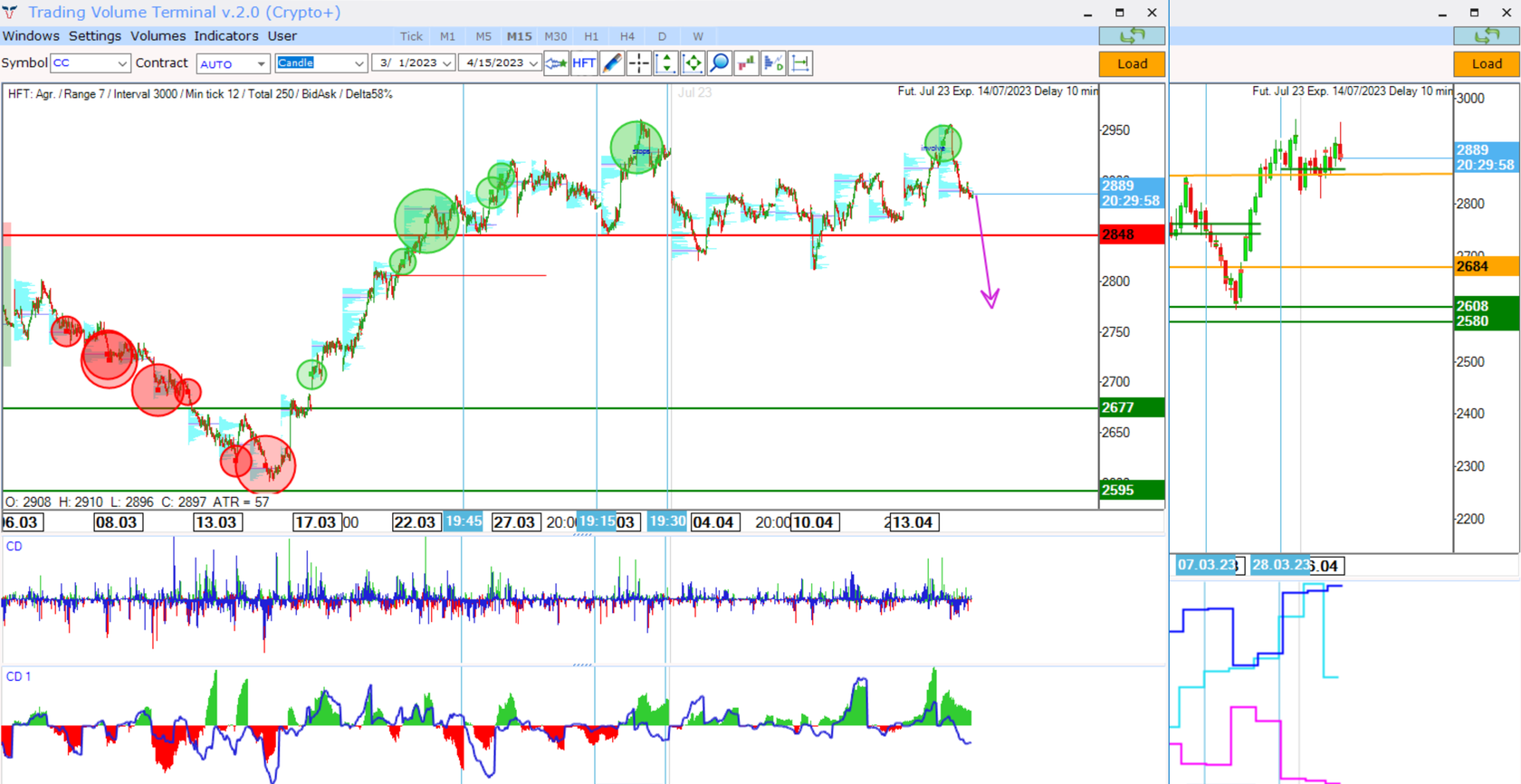

▪️ Cocoa (CC) also has a potential for a reversal to its balance after ask volumes were absorbed.

🐣 Heapy Easter! And wish you peace, love, and harmony which Christ brought to Earth.

(Previously published in TVT School)

Sincerely, Taras Sviatun